Family Offices: What They Get Right About Security, and What Companies Can Learn from Them

Family offices are privately held companies that often handle wealth management and investments for heads of companies, executives, and high-profile individuals—many of whom are quite wealthy.

But these organizations often have broader responsibilities. Over the years, they’ve become among the best when it comes to protective intelligence and personal protection for high-net-worth individuals and their extended family members.

It’s not the nearly unlimited resources of their principals that make family offices so good at personal protection and security. In fact, many carry out their protection, safety, and security responsibilities with very little fanfare or special equipment. Instead, it’s the speed of decision-making, the unrelenting focus, and the quiet discretion with which they carry out their duties that merits recognition.

SponsoredInside the Shadows of Alt-Tech Social Networks: The New Haven for Threats Against ExecutivesIn recent years, criminals and fringe groups have started moving to a growing collection of “alt-tech” social networks. And as a result, these communities have become breeding grounds for doxxings, false rumors, and violent extremists – posing a serious risk to executives and high-ranking employees. So how do protectors respond to this threat? |

In protecting some of the highest-profile individuals who attract the most unusual risks, these family offices are often at the forefront of security innovation. Here are some things that family offices get right which, when adopted by organizations, can help transform your security program.

Protect, yet remain unobtrusive. High profile executives and their families don’t want to dramatically change their lifestyles to address security concerns. They’re looking for common sense security solutions that ensure risks will be addressed without putting their lives on hold or abandoning their favorite locations or activities.

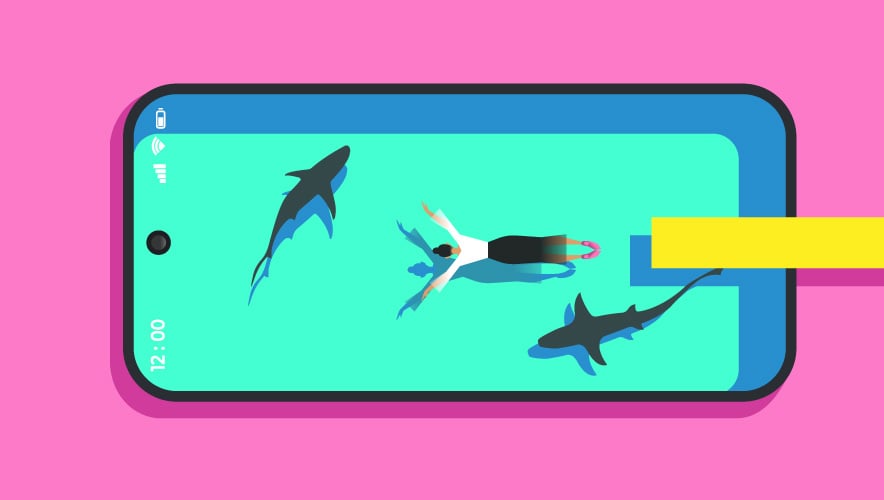

While there are some who employ a “goons with guns” approach to security, family offices have found innovative ways to use security personnel and procedures that ensure protection that is often hidden in plain sight. Many organizations could learn from this approach.

Building out the most high-profile and robustly visible security measures does not always translate into better security and may even cause employees to avoid such security measures. Applying a family office mindset and using security tools and procedures in a way that seamlessly—and often invisibly—integrates with operations can transform protective intelligence teams into business facilitators.

Protect the inner circle but don’t neglect the periphery. Family offices have learned to focus on a wide variety of risks, including those directly impacting the highest profile family members and those that could affect everyone in the family’s orbit.

For example, extended family members are often targets for social engineering, attempts to steal personal information, or even violent incidents like home invasions. Family offices usually protect an extended network of family. They train their security team and their protectees on everything from cybersecurity and privacy on social media, to kidnapping risks and romance scams. A major incident on the periphery can have effects that last generations.

A major incident on the periphery can have effects that last generations.

So, what can business leaders learn here? Even if the highest impact threats will only target a few individuals, the consequences of an attack on the periphery can still be devastating: the loss of a vital colleague, damage to morale, or a feeling that the organization didn’t do enough to keep everyone safe. Even if the threats to others within the organization aren’t as severe as those to the leaders, find innovative ways of ensuring everyone in the organization’s orbit is countering threats appropriately. This is especially important when the business image and reputation are at risk.

Identify appropriate technology solutions and adopt them quickly. Technology, when implemented well, is a force multiplier that provides far more value than its cost. But large organizations often find themselves going through endless rounds of discussions when making decisions about adopting new technology, allowing budgets and lack of technical understanding to dictate whether a critical problem will be solved. It can be a case study in being penny wise and pound foolish: saving a little money while remaining exposed to risks that dwarf the actual expenditure of time or money.

In my experience, family offices seem to do a very good job of balancing the upside of new technology with its cost, focusing on quickly solving the most critical and high impact problems that can be addressed with a specific technological solution.

Over the years, I’ve counseled several high-profile wealthy individuals on their security. They’ve spent decades building large, enduring businesses, or managing legacy family wealth. They typically take security and privacy seriously. Though the threat landscape they face can be wide and complex, and risks more personal and close-to-home, they work with family offices that can use the most innovative solutions and leverage emerging technology to create a security environment that is comprehensive yet unobtrusive.

That, to me, is the big lesson for organizations. Building a more secure organization is a mindset of innovation as much as an investment.

Fred Burton is an expert on security and counterterrorism, having served on the front lines of high-profile investigations such as the hunt for and arrest of Ramzi Yousef, the mastermind behind the first World Trade Center bombing and the search for Americans kidnapped by Hezbollah in Beirut, Lebanon. A former police officer and New York Times best-selling author, he is executive director of the Ontic Center for Protective Intelligence.

© Fred Burton, Ontic