Security Market Growth Continues

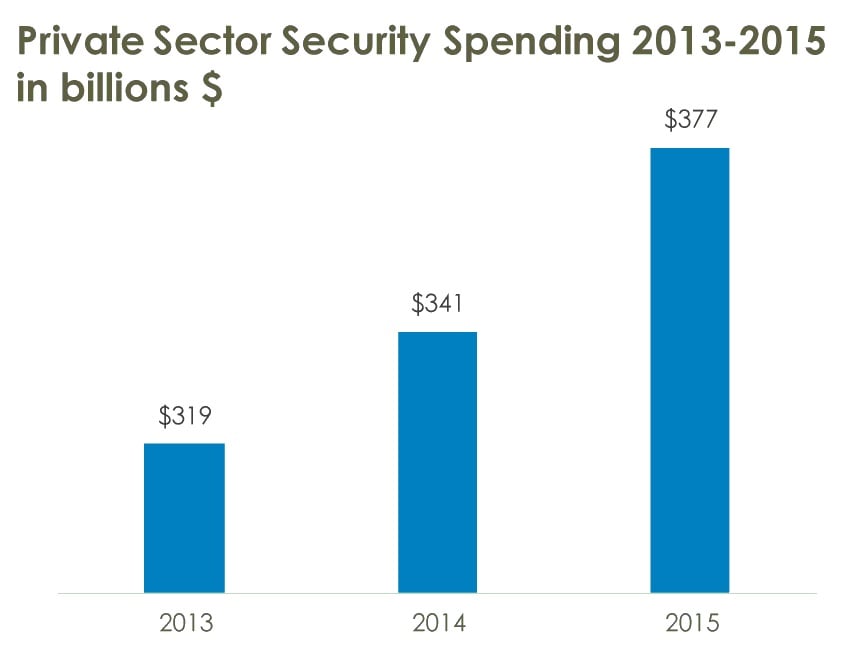

Recent surveys conducted by ASIS International, iView Systems, and the Institute of Finance and Management showed a solid growth rate in overall private security spending, with $341 billion in 2014 and a projected $377 billion in 2015. Those numbers are conservative because spending in other industries, such as facilities management and emergency management services, often goes unaccounted. These figures correspond with other major industries, including the utility industry at $400 billion and education at $324 billion. While the private sector is driving security spending, the federal government is projected to spend $71 billion in 2015, for a total expenditure of $448 billion.

Factors spurring that growth include the inability of police to investigate or prevent crime, such as sophisticated financial fraud; growing number of federal regulations; increasing active shooter cases; globalization and expansion into new markets; and a spate of natural disasters and fear of natural disasters. Key drivers for growth include cost reduction, greater use of technology, and increased physical security risks.

Security product and equipment spending reached $66 billion in 2014, with $73 billion projected for 2015. Some find it surprising that IT spending now tops security products and equipment spending, and that gap will likely continue to grow. Spending on IT security reached $35 billion in 2014 and $39 billion in 2015, as opposed to $31 billion and $34 billion for operational security.

Meanwhile, private sector spending on operational security is three or four times higher than IT security ($147 billion on operational compared to $43 billion on IT security). However, within those numbers, IT security tops operational security with a much higher percentage spent on staff training ($3 billion in operational and $8 billion in IT). Also, in terms of repair and maintenance, more upgrades and licensing costs are required in IT security.

Survey respondents ranked from one to six their top security operations concerns for the next two years. Not surprisingly, the number one concern was operating budgets, with economic and cost reduction pressure from the business. Security and risk management as an integrated element of overall business strategy came in heavily behind that. That pointed toward the return on investments and the business value of overall physical security environment. In third place came compliance and regulatory issues, followed by convergence and integration and the requirement to share and access information in real time.

Consulting, Planning and Management

The survey revealed that the consulting, planning, and management service industry is one of the most fertile areas for spending growth among security services. More than one out of four companies is increasing spending on consulting in 2015, and that number almost rises to one third over a two-year period. Not a single respondent plans to cut spending on consulting services. Those industries that will be spending the most include technical service firms, law firms, research and development firms, transportation firms, utilities, and large companies with more than $1 billion in revenue.

The survey also looked to identify where that money is coming from and how that reporting structure affects spending. IT and physical security remain under separate reporting structures; 79 percent do not report to a higher power, while only 22 percent of respondents have IT and physical security under the same reporting structure. True integration between IT and security in a single department is rare.

This article is excerpted from the webinar and whitepaper Trends, Technology, and Transition in Physical Security

Download complete white paper from the iView resources panel:

http://www.securitymanagementbuyersguide.com/Entry/iview-systems.aspx

Watch the archived version of the webinar:

http://event.on24.com/r.htm?e=919240&s=1&k=766AA366C811D6DC07F41D450C53A74B